When a life-saving drug costs $10,000 a year in one country and $75 in another, it’s not because one is richer than the other. It’s because of TRIPS-a global patent rule that decides who can make generic drugs and who can’t.

What TRIPS Actually Does

The TRIPS Agreement, created in 1995 under the World Trade Organization, forced every member country to give drug companies at least 20 years of patent protection. Before TRIPS, many developing countries didn’t even allow patents on medicines. They made their own versions using different manufacturing methods. That changed overnight. By 2010, 147 of 151 developing countries had to rewrite their laws to match TRIPS rules. The result? Prices for patented drugs jumped by 200% to 500% in places like India, Brazil, and South Africa.TRIPS didn’t just protect patents-it added hidden barriers. Data exclusivity means regulators can’t approve a generic drug based on the original company’s clinical trial data for 5 to 10 years, even after the patent expires. That delays generics without a patent being in force. Patent linkage locks generic approval to patent status, so even if a patent is weak or disputed, the generic can’t enter the market. These aren’t in TRIPS. But rich countries slipped them into trade deals anyway. Today, 85% of U.S. free trade agreements include these extra restrictions.

Compulsory Licensing: The Loophole That Almost Didn’t Work

TRIPS does have a safety valve: compulsory licensing. If a country faces a health emergency, it can let a local company make a generic version without the patent holder’s permission. But here’s the catch: the license must be used mostly for the domestic market. That meant countries without drug factories-like Rwanda or Malawi-couldn’t import cheaper generics from India or Brazil, even if they had the legal right.In 2001, the Doha Declaration said public health matters more than patents. But it didn’t fix the problem. In 2005, WTO members agreed to a workaround called the “Paragraph 6 Solution.” It allowed one country to export generics made under compulsory license to another country that couldn’t make them. Sounds simple, right? It wasn’t. The paperwork was so complex, and the rules so narrow, that only two shipments ever happened before 2016: one from Canada to Rwanda for HIV drugs, and one from Canada to Thailand for flu medicine.

Why? Because the exporting country had to prove the importer had no manufacturing capacity. The importer had to label every pill with a special code. The whole process took over a year. By the time the drugs arrived, the emergency was often over. Real-world access didn’t improve. The system was designed to look like it worked, not to actually work.

India’s Turnaround and the Global Generic Engine

India was the world’s pharmacy before TRIPS. It made cheap generics using process patents-making the same drug in a different way. When TRIPS forced India to switch to product patents by 2005, the world feared the worst. Would generics vanish? Would HIV drugs become unaffordable?They didn’t. India’s courts and regulators pushed back. They rejected evergreening-small, meaningless patent tweaks meant to extend monopolies. They allowed generics to enter the market as soon as the real patent expired. They didn’t accept data exclusivity unless the law required it. And they kept making drugs for the rest of the world. Today, 80% of the antiretroviral drugs used in low-income countries come from India. Generic makers like Cipla and Natco don’t just save lives-they cut prices. One HIV drug dropped from $10,000 a year to $75 because of Indian generics.

But India’s success isn’t universal. Countries without strong legal systems, regulatory capacity, or political will couldn’t follow. Many African nations still struggle to approve generics because their health ministries lack staff, training, or funding. TRIPS didn’t just change laws-it demanded infrastructure. And most countries didn’t get the help they needed.

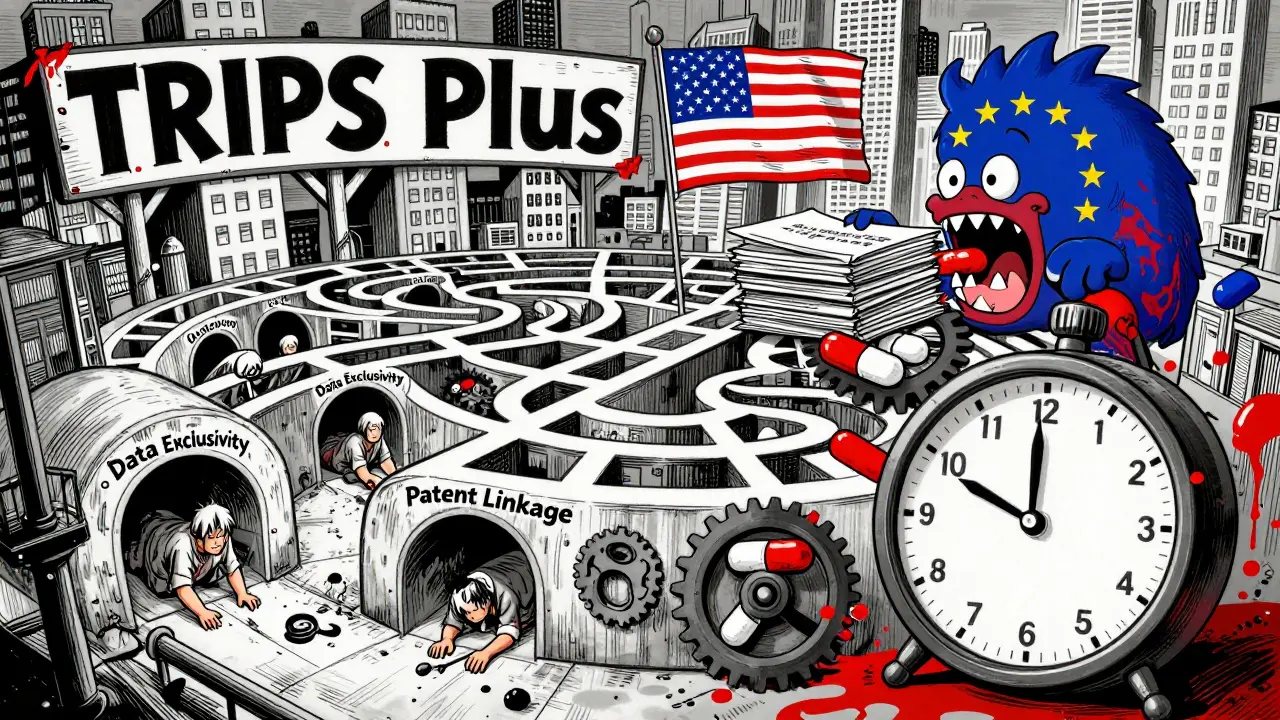

TRIPS Plus: The Hidden Rules No One Talks About

The real battle isn’t happening at the WTO. It’s happening in quiet trade talks between rich countries and smaller ones. The EU, U.S., and Switzerland push “TRIPS Plus” terms into bilateral deals. These go beyond what TRIPS requires: longer patent terms, stricter data exclusivity, patent linkage, and bans on compulsory licensing for certain diseases.The EU-Vietnam Free Trade Agreement, signed in 2020, gives 8 years of data exclusivity-three years more than TRIPS allows. The U.S.-Morocco FTA bans compulsory licensing for all medicines, not just emergencies. These deals lock countries into stricter rules forever. Even if a country wants to use a TRIPS flex later, it’s already bound by the trade deal. And there are over 300 such agreements in force worldwide. Most developing countries signed them hoping for better market access. Instead, they traded public health for trade deals.

The Pandemic Test: Did TRIPS Change?

In 2020, India and South Africa asked the WTO to temporarily waive TRIPS protections for COVID-19 vaccines and treatments. Over 100 countries supported it. The U.S., EU, and Switzerland blocked it for over a year. They argued that patents were needed to drive innovation. But the data didn’t back them up. The mRNA vaccines were built on decades of publicly funded research. The companies didn’t invent them from scratch-they scaled what others had already built.In June 2022, the WTO agreed to a limited waiver. It allowed countries to export generic versions of COVID-19 vaccines without patent permission. But only for vaccines. Not for treatments. And only for low- and middle-income countries. The waiver had so many conditions that only one company, the Serum Institute of India, ever used it. The rest didn’t bother. The system was still too slow, too complex, too risky.

By 2023, the waiver had done almost nothing. Meanwhile, the cost of a single course of Paxlovid, a patented antiviral, stayed above $500 in most places. Generic versions? Still blocked by patent thickets and data exclusivity. The pandemic proved one thing: TRIPS wasn’t broken. It was working exactly as designed-to protect profits, not people.

Who Wins? Who Loses?

The winners are clear: big pharmaceutical companies. Between 2010 and 2020, 70% of new drugs came from firms in countries with strong patent systems. Their profits soared. The losers? Patients in low-income countries. In 2019, 65% of them reported delays in getting generic medicines because of patent rules that went beyond TRIPS. For diseases like hepatitis C, tuberculosis, and cancer, generics exist-but they’re locked behind legal walls.The Medicines Patent Pool, created in 2010, has helped. It negotiates voluntary licenses with drug companies to let generic makers produce cheaper versions. So far, it’s reached 17.4 million patients. But it’s a Band-Aid. It only works if companies agree to participate. And they don’t have to. They choose which drugs to license, which countries to serve, and when to stop.

Meanwhile, the global generic medicine market is worth $420 billion. But over 80% of that is in rich countries. In low-income regions, most medicines are off-patent-but still out of reach because of weak supply chains, corruption, or import bans tied to patent claims.

What Needs to Change

TRIPS isn’t evil. But it’s outdated. It was written in 1994, when HIV was a death sentence and no one imagined mRNA vaccines. The world has changed. The rules haven’t.Three fixes would make a difference:

- Remove the “domestic market” rule from compulsory licensing. Let countries import generics freely.

- Ban TRIPS Plus provisions in trade deals. No country should be forced to give up public health rights to get a trade agreement.

- End data exclusivity for medicines. If a drug is off-patent, regulators should be free to approve generics using existing data.

These aren’t radical ideas. They’re basic fairness. The same drugs that cost $10,000 in the U.S. cost $75 in India. The difference isn’t quality. It’s policy. And policy can be changed.

For now, the system still favors patents over people. But history shows it doesn’t have to.

Does TRIPS ban generic drugs?

No, TRIPS doesn’t ban generics. It allows them after patents expire. But it adds layers-like data exclusivity and patent linkage-that delay generic entry by years, even when patents are no longer active. So while generics are legal, they’re often blocked by legal and bureaucratic hurdles.

Can a country make its own generic drugs under TRIPS?

Yes, but only under strict conditions. A country can issue a compulsory license to produce a generic version if there’s a public health emergency, and if it first tried to get a voluntary license from the patent holder. But the license must be used mostly for its own market. That means countries without drug factories can’t import generics from others-even if they’re legal.

Why did India become a hub for generic drugs?

India had a long history of making generics using process patents before TRIPS. When TRIPS forced it to switch to product patents in 2005, India’s courts and regulators resisted strict interpretations. They rejected minor patent extensions, didn’t enforce data exclusivity, and allowed generics to enter as soon as the real patent expired. That made India the world’s largest supplier of affordable medicines.

Are TRIPS rules the same for vaccines and pills?

Legally, yes. But politically, no. During the COVID-19 pandemic, the WTO approved a limited waiver for vaccines only-not for treatments or diagnostics. That showed the system is flexible when pressure is high, but only in narrow cases. The same rules still apply to all medicines outside of emergencies.

What’s the difference between TRIPS and TRIPS Plus?

TRIPS is the minimum global standard set by the WTO. TRIPS Plus are stricter rules added by rich countries in bilateral trade deals-like longer patent terms, data exclusivity, and bans on compulsory licensing. These aren’t required by TRIPS, but countries often accept them to get access to bigger markets. That means many nations now follow rules even tougher than the global standard.

Why don’t more countries use compulsory licensing?

Because it’s risky. Countries that try-like Thailand and Brazil-faced trade threats, lawsuits, or political pressure from the U.S. and drug companies. The legal process is slow. The political cost is high. And even if they succeed, the export rules make it hard to get drugs from other countries. Most governments decide it’s easier to pay high prices than to fight.

Do patents really drive innovation in medicines?

Partly. But most breakthroughs come from publicly funded research. The mRNA technology behind COVID vaccines was developed over 20 years with billions in government funding. Private companies then built on it. Patents protect the final product, not the original science. And many new drugs are minor tweaks of old ones-not real innovation. The real question is: who benefits? Patients or shareholders?

Can a country ignore TRIPS?

Technically, no. All WTO members must follow TRIPS. But enforcement is weak. Only rich countries can bring cases, and they rarely do unless a country threatens their profits. India, Brazil, and South Africa all made generics despite legal threats-and survived. TRIPS is powerful, but not absolute. Political will matters more than the rulebook.

Okay but like... why are we even pretending this is about health? It's about shareholders and boardrooms. $10,000 for a pill? That's not capitalism, that's extortion with a law degree. And don't give me that 'innovation' crap - if innovation meant saving lives, we'd all be getting free insulin and HIV meds like candy.

This is so real 😭 I had a friend in Kenya who couldn't get her TB meds because of patent stuff... and here we are, paying $800 for a 10-day course of something that costs $12 elsewhere. Why does it feel like the world is designed to make poor people suffer quietly?

Interesting breakdown. I never realized how much of this was hidden in trade deals. Like, who even reads these agreements? They’re written in legalese so dense it could choke a lawyer. And then we wonder why people distrust institutions.

Stop pretending this is a moral issue. Patents exist for a reason - to reward innovation. If you want cheap drugs, go live in a third-world country and stop complaining about the system that gave you your iPhone and your antidepressants. You can't have both.

India didn’t just "become" the pharmacy - we fought for it. Courts fought. Lawyers fought. Patients screamed. We didn’t wait for permission. We made the law bend. And now? The West calls us "copycats" while they profit off our labor. Hypocrisy has a name - it’s called the Global North.

Let me tell you something simple. When a child in Uganda gets an HIV pill for $1, it’s because someone in India said NO to the patent. Not because of WTO. Not because of the UN. Because a factory worker in Gujarat made it. That’s the real story. No speeches. Just medicine.

TRIPS? HA! It's all a CIA plot to keep America healthy while the rest of the world dies. Big Pharma owns the WTO, the FDA, and your local pharmacy. They're not selling drugs - they're selling control. And now they want to patent your DNA next. Wake up, sheeple.

Oh wow, India saved the world? Cool. So why are their own people still dying of diabetes? If generics are so great, why isn't your uncle in Delhi getting his insulin for $5? Maybe the real problem isn't patents - it's corruption, incompetence, and bad infrastructure. But sure, blame the West.

Patents are not a moral issue. They are legal. And breaking them is theft. End of story.

I mean… it’s wild how we treat medicine like a luxury item. We don’t do that with water, or electricity… but somehow, when it’s a pill, suddenly it’s "intellectual property"? That’s not logic - that’s greed dressed up in a suit.

It is incumbent upon us to acknowledge that the TRIPS Agreement was established as a multilateral framework to harmonize intellectual property standards across sovereign jurisdictions. To suggest that its provisions are inherently inequitable is to conflate structural economic disparity with legal normativity. The remedy, therefore, lies not in the abrogation of patent protections, but in the augmentation of global health financing mechanisms.

This made me cry. I work in public health and see this every day. The fact that we have the science to cure so many things but still let people die because of paperwork… it’s unbearable. Thank you for writing this. 💔🫂

TRIPS is just the tip. The real game? The WHO, Gates Foundation, and Big Pharma are all connected. They fund the NGOs that push for "access" - but only for drugs they control. The moment a country tries to make its own, the funding disappears. It’s not about saving lives - it’s about controlling the supply chain. They want you dependent. And they’re winning.